What Does the Future Hold for Fleet Sales to Car Rental?

With domestic automakers pulling back on rental fleet sales and lower overall light-duty sales projected, the car rental industry will have to adjust.

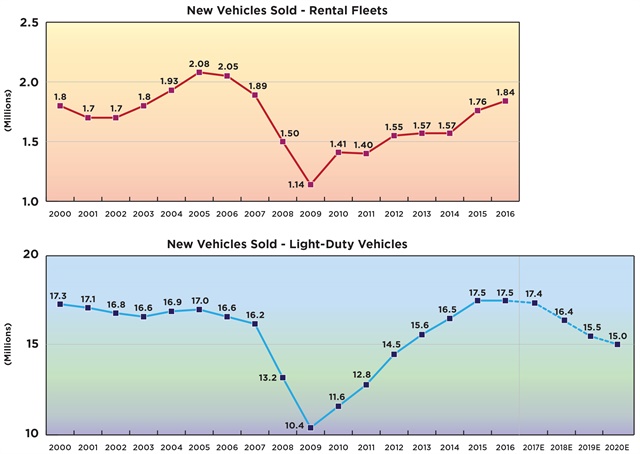

Overall, car rental companies fleeted 1.82 million new vehicles in the U.S. in 2016, according to statistics collated by Bobit Business Media, representing a 4% gain over 2015 rental fleet sales of 1.75 million vehicles.

When looking at overall light-duty sales, the industry sold 17.55 million units in 2016, according to Autodata Corp. This is an all-time record, but it’s only a barely discernable increase from the 17.5 million units sold in 2015.

Then was that 4% sales increase into rental fleets justified? Is the car rental industry over-fleeted? The answer is one with many moving parts, including demand, car rental transactional volume, and vehicle hold times.

A 4% gain has some justification from a volume standpoint, based on quarterly data from Avis Budget Group and Hertz. (Enterprise Holdings is privately held.) While we wait for fourth quarter numbers, through the first nine months of 2016 Avis saw a 4% increase in total rental days in its Americas segment, while Hertz realized a 3% increase in the same period in the U.S. Nonetheless, this didn’t help almighty pricing — both companies experienced pricing declines in those nine months.

In other industries, demand has a more direct correlation with production. But that’s less of adriver with car rental. Historically, sales into rental fleets have been more closely aligned with total light-duty vehicle sales (see charts). Rental fleet sales have traditionally been one lever pulled by auto manufacturers to move metal.

Last year, rental fleet sales represented 10.4% of the overall U.S. sales total. While this percentage has been trending slightly higher in the last four years, it’s not alarming, and the charts show that it’s on the low end, looking back to the beginning of the millennium. The lowest percentage of rental sales compared to total sales was 9.5% in 2014. The highest was 13.2% in 2007, just before the Recession — when in retrospect it’s generally accepted that the industry was over-fleeted.

If today’s pattern isn’t alarming, what might the future hold?

As rental fleet sales are tied to overall sales, one metric to monitor is projected future auto sales. For many reasons, we may never reach 17.55 million vehicles sold again. In fact, Autodata predicts that overall sales will decline to $15 million by 2020. Assuming rental car demand remains steady, the rental industry would want to fleet close to 1.8 million vehicles moving forward. Will rental fleets get to keep 10% of that shrinking pie?

Domestic auto manufacturers have gone public recently in their desire to conserve vehicles for more profitable retail sales. General Motors has made good on that promise, as did Chrysler in the last half of 2016. Ford’s sales to rental were essentially flat year-over-year. However, those losses were made up for, and then some, from foreign manufacturers to drive the overall 4% gain.

If we’re on the downward slope from peak auto sales, there may be a residual overhang of vehicle production compared to demand, and those extra units could find a home in rental fleets. Ultimately, though it may take a few years, vehicle production would gear down to meet lower projected sales.

In this impending environment of lower overall sales, fleeting rental may be harder — or costlier — at least initially. Of course rental fleets could increase length of service to compensate, as we saw during the Recession. But the overall benefit would be a tighter used car market, which would boost residual values. For fleets, this would keep holding costs in check.

We’re seeing the beginning of the movement today away from car ownership and toward higher utilization of multiple transportation options, which include competition from new players such as ride-hailing companies and now auto manufacturers’ carsharing programs.

But in light of fewer car sales, we’re not taking fewer trips — in fact the U.S. Department of Transportation predicts modest 20-year growth in vehicle miles traveled. In this environment, there would seem to be enough demand to be satisfied by multiple transportation types, including car rental.

Predicting actual rental car demand is fodder for another blog post. But the days of the two-car household are waning. This is a good thing for car rental, though it may not fully realize for a while